/best-time-to-trade-forex-us/Introduction

Timing is everything in forex trading—especially when you’re targeting the highly liquid and fast-moving U.S. market. Knowing the best time to trade forex in the US can significantly increase your chances of making profitable trades. In this guide, we’ll cover key trading sessions, the most active market hours, and proven strategies to help you capitalize on peak trading times in 2025.

1. Forex Market Overview

The forex market operates 24 hours a day, five days a week. It is divided into four major sessions:

- Sydney Session

- Tokyo Session

- London Session

- New York Session

The most lucrative opportunities often occur when two sessions overlap, especially when they involve high-volume markets like the U.S. and Europe.

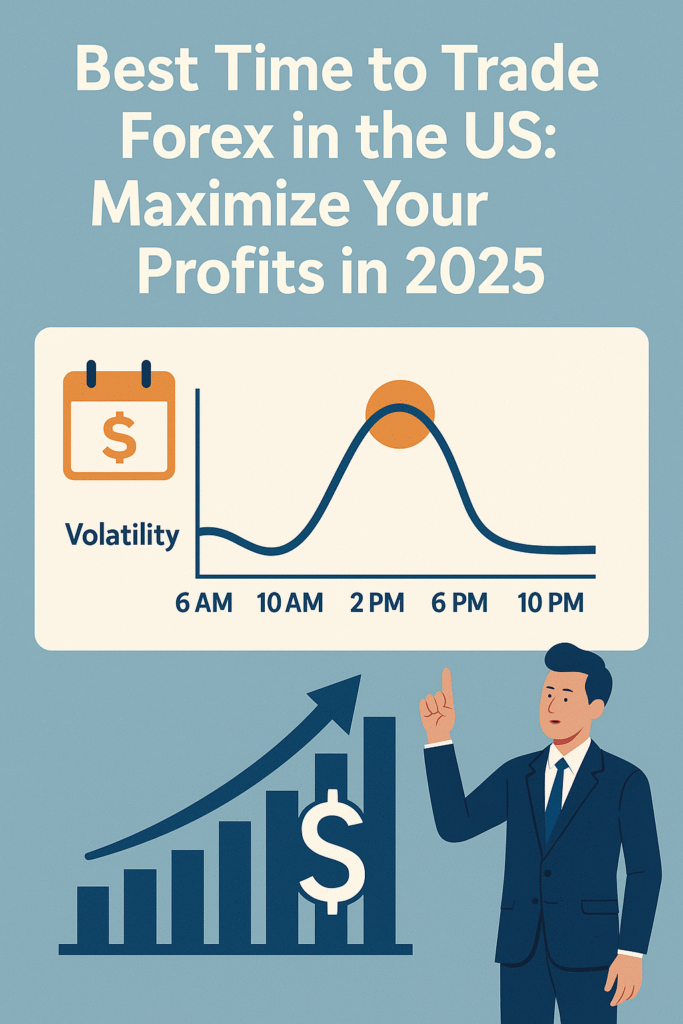

2. Best Time to Trade in the US (Eastern Time)

Here are the most active and potentially profitable times to trade:

- London/New York Overlap (8:00 AM – 12:00 PM EST): This is widely considered the best time to trade due to high liquidity and volatility. Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY are most active during this period.

- New York Session (8:00 AM – 5:00 PM EST): Even outside of the overlap, the New York session offers high-volume trading, especially in USD pairs.

- Avoid Low-Volume Hours (5:00 PM – 7:00 PM EST): This is a lull period between the U.S. market close and the Sydney market open. Price movements tend to be slow and unpredictable.

3. Key Economic Reports to Watch (U.S. Market)

Some U.S. economic data releases can cause high volatility in the forex market:

- Non-Farm Payrolls (NFP)

- CPI (Consumer Price Index)

- FOMC Statements

- Interest Rate Decisions

- GDP Reports

Timing your trades around these releases can provide opportunities—but also risks.

4. Tips to Maximize Your Profits

- Use an Economic Calendar: Stay updated with news events and schedule your trades accordingly.

- Trade During High Volatility: Focus on the overlap between the London and New York sessions.

- Set Stop-Loss Orders: Protect your capital during fast market moves.

- Analyze Historical Data: Identify patterns in market behavior at specific hours.

5. Conclusion

The best time to trade forex in the US is during periods of high liquidity, especially the overlap between the London and New York sessions. By aligning your trading strategy with the most active hours and keeping an eye on major economic events, you’ll be in a better position to grow your forex profits in 2025.